A new health and social care tax is being introduced to help the NHS recover from the Covid pandemic and improve social care in England.

But there has been criticism - including from within the Conservative Party - that it will be unfair on younger people.

What is the new tax and who will pay it?

Employees and the self-employed will pay more tax from April 2022.

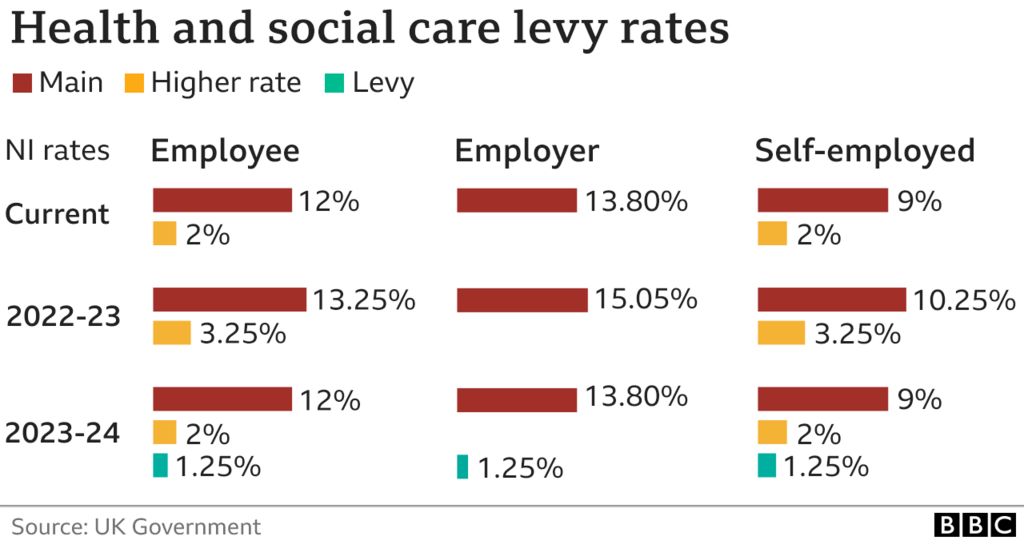

At first this will be as a 1.25 percentage point increase in National Insurance.

From April 2023 National Insurance will return to its current rate, but a new health and social care tax will be introduced at a rate of 1.25% - making up for the change to National Insurance.

On wage slips it will appear as a "Health and Social Care Levy".

The levy - unlike National Insurance - will also be paid by pensioners who work.

People who earn under £9,564 don't have to pay National Insurance or the new levy.

Employers will pay more National Insurance - and the levy.

How much will the tax changes cost me?

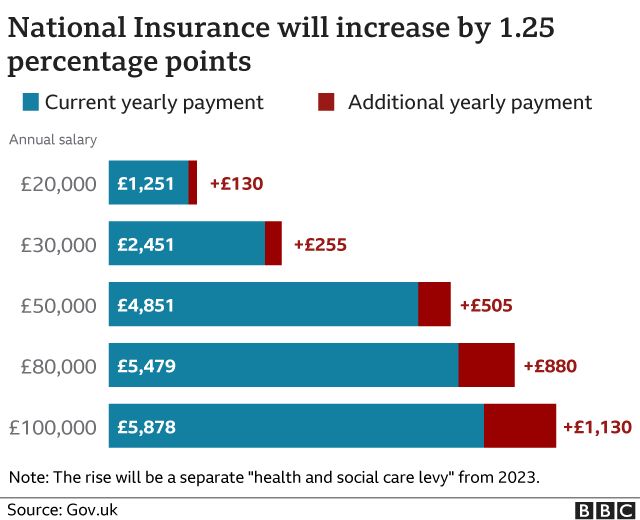

Somebody on £20,000 a year will pay an extra £130, while someone on £50,000 will pay £505 more.

The same increase will still apply after the National Insurance rise is replaced by the Health and Social Care Levy in 2023.

What are the criticisms of the tax increase?

There are concerns that this increase will have a higher impact on the lower-paid.

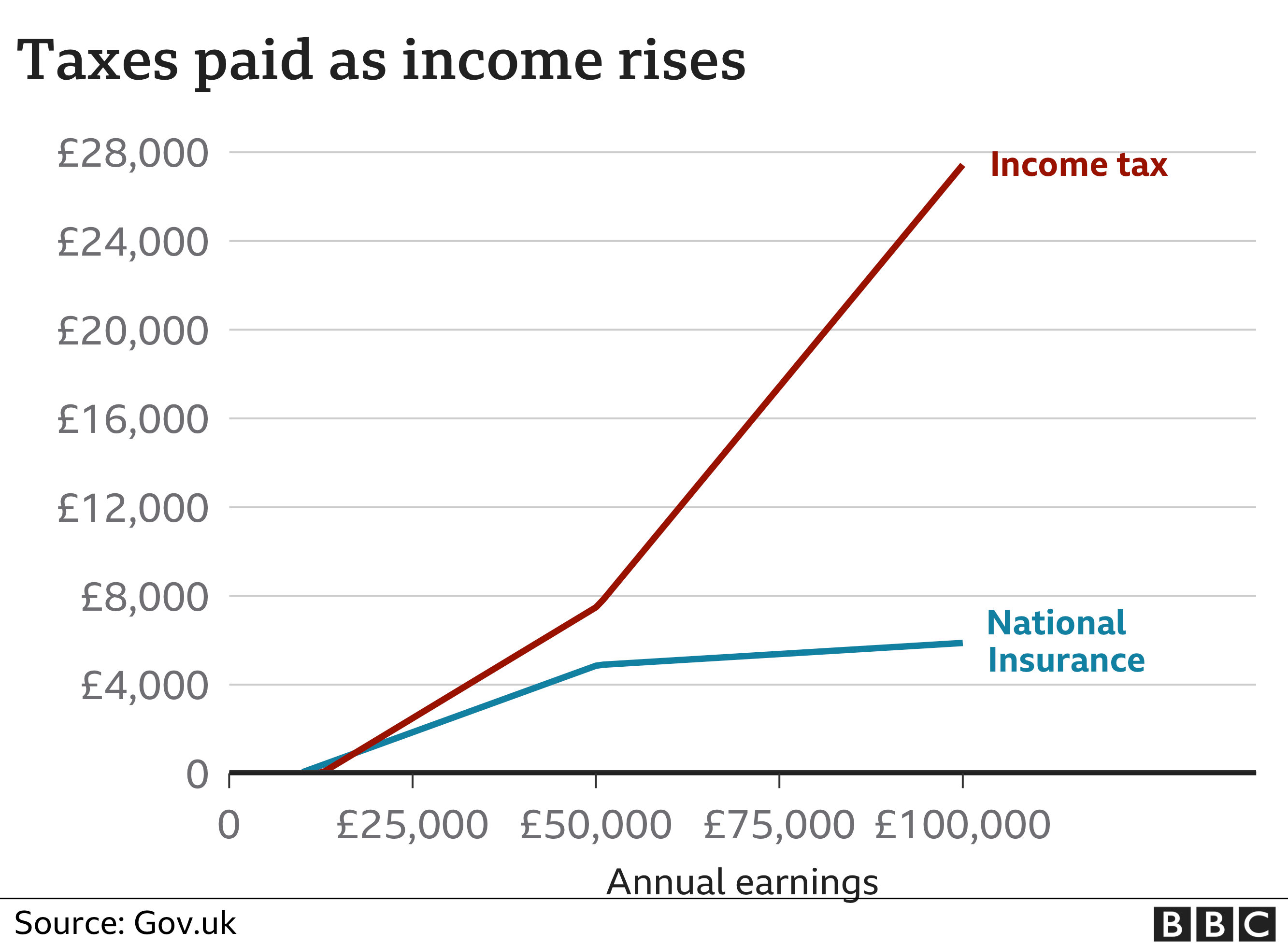

Currently workers pay 12% National Insurance on earnings between £9,564 and £50,268. However, anything earned above this amount attracts a rate of just 2%.

This makes National Insurance different from the rate of income tax, which rises from 20% to 40% after you reach annual earnings of about £50,000.

The same principle will still apply when the National Insurance increase is replaced by the Health and Social Care Levy.

Following the announcement, Paul Johnson, director of the Institute for Fiscal Studies said "pensioners will pay next to nothing for this social care package - overwhelmingly to be paid by working age employees".

Former Conservative minister Jake Berry MP said the changes would disproportionately affect working people "on lower wages than many others in the country". He said they would end up "paying tax to support people to keep hold of their houses in other parts of the country where house prices may be much higher".

Also, the government said in its 2019 manifesto that it would not raise National Insurance or income tax.

However, Boris Johnson said the increase was necessary given the pandemic and the burden it placed on the NHS.

What other options have been suggested for raising the money?

The government says the changes are expected to raise £12bn a year.

However, the Resolution Foundation think tank said increasing the level at which workers start paying - closer to the starting rate for income tax - would protect lower earners.

It has also been suggested that an increase in inheritance tax could be used to help fund social care.

But it would take a big increase to the rate of inheritance tax, or a big cut to the amount that may be inherited tax-free, to raise the £10bn needed.

What is social care?

The money raised from the tax rise will initially go towards easing the NHS backlog, before a proportion is is moved into social care over the next three years.

The social care system mainly helps older people and people with high care needs, with tasks such as washing, dressing, eating and taking medication.

Under the government's changes, people in England will pay no more than £86,000 in care costs from October 2023. This is for actual care, rather than accommodation and food.

In addition, anyone with assets (which may include your home) worth less than £20,000 will have their care fully covered by the state.

Those who have between £20,000 and £100,000 in assets will have their care costs subsidised.

What's the present arrangement?

At present, to get your care paid for by your local council, you must have a very high level of need and also savings and assets worth less than £23,250 in England.

Below that level the amount you pay reduces until you have less than £14,250, at which point the council pays for your care if you qualify.

The care system is under pressure because of an ageing population and the pandemic. It has been hit by staff shortages and falling government spending.

This has also put pressure on the NHS because people cannot be discharged from hospital if they don't have anywhere suitable to go.

What happens in the rest of the UK?

In Wales, no-one who is eligible for care at home is expected to pay more than £100 a week.

The systems in Northern Ireland and Scotland are different for support at home and residential care.

In Northern Ireland, no-one over the age of 75 pays for home care.

Scotland provides free personal care for people who are assessed as needing support at home, whatever their age.

In Scottish care homes, people get free care if they have savings or assets of less than £18,000.

Those with savings and assets of between £18,000 and £28,750 have to fund part of their care.

People with more than that have to fund their own care, apart from a £193.50 a week contribution towards personal care and £87.10 a week towards nursing care.

"social" - Google News

September 07, 2021 at 10:52PM

https://ift.tt/3zOblc1

National insurance: What’s the new Health and Social Care tax and how will it affect me? - BBC News

"social" - Google News

https://ift.tt/38fmaXp

https://ift.tt/2WhuDnP

Bagikan Berita Ini

0 Response to "National insurance: What’s the new Health and Social Care tax and how will it affect me? - BBC News"

Post a Comment